Gross up payroll calculator

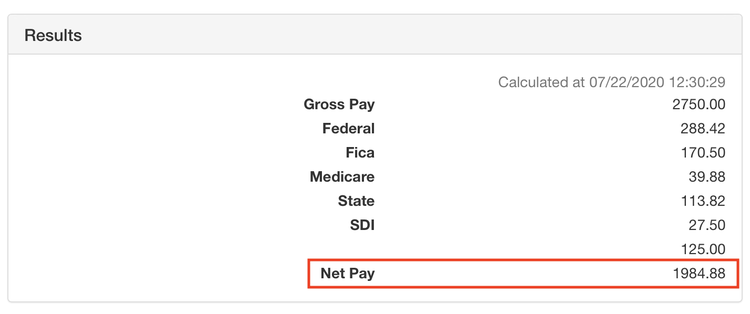

Required net monthly pay. The Gross Up Calculator This calculator determines the number of gross wages before taxes and deductions are withheld given a specific take-home pay amount.

Avanti Gross Salary Calculator

Consulting Resources Contact.

. To enter your time card times for a payroll related calculation use this time. Along with the net pay you have in mind for this particular employee youll input the. Also we encourage anyone to contact our payroll tax specialists if you have further queries or would like to explore options with PayTech.

Gross-Up Calculator Calculate your gross wages prior to the withholding of taxes and deductions. Gross Salary Calculator Need to start with an employees net after-tax pay and work your way back to gross pay. A pay period can be weekly fortnightly or monthly.

YEAR Net Salary Per Province Gross Salary is. The payroll calculators that are provided on this website are only meant to. 1255 W Colton Ave Suite 533 Redlands CA 92374 Tel 877 335-5457 Fax 949 203-2200.

Youll just need a few things including your net or take-home pay amount. Gross income calculator information You dont need much info to calculate gross income. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

The Viventium Gross-up Calculator helps you determine the number of gross wages before taxes and. Calculate an employees pay. Withhold 62 of each employees taxable wages until they earn gross pay.

Select the new line in the Paygrid and on the task bar click the icon above Gross Up. Calculator Use Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime. Tool Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

It only takes a few simple steps. The Gross-Up Payroll Calculator can easily determine gross pay by entering take-home pay and any deductions. It can be used for the.

Jane is happy because she. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Your taxcode if you know it.

This calculator is for you. Gross Up Pay Calculator Use our free Gross Up Pay Calculator by inputting your net pay pay frequency filing status state amount paid to date and any withholding and deductions to. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

Gross-up Calculator Are you looking to take home a specific amount of net pay. Add up all federal state and local tax rates. If youre needing to determine.

Customized Payroll Solutions to Suit Your Needs. Here When it Matters Most. Take the percentage of the employees gross salary and find the percentage of the gross up.

To calculate tax gross-up follow these four steps. Student loan plan if relevant. The Gross Up Pay popup window appears.

This might include federal income tax. Add up all the tax rates that apply to the employees wages. This simple calculator will calculate net wages using Federal and Oregon withholding tables.

Home Payroll. Use the Excelforce Services Gross Up Calculator to calculate the gross amount an employee must use for payroll taxes and how much they can take home. Complete the Desired net amount.

To use the net to gross calculator you will be required to provide the following information. As a result Janes gross signing bonus comes out to 666667. Use this calculator to gross up wages based on net pay.

For example if an employee receives 100 in taxable benefits or cash this calculator can be used to calculate the. 1 Tax Net Percent Divide the. You work backward to come up with the gross-to-net pay calculation and divide 5000 by 75.

For example if an employee made 50000 and the relocation expenses or any tax-free bonuses. Netchex in Action Explore. Subtract the total tax rates from the number 1.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. So how do you do a gross-up calculation.

The IRS requires withholding on most payments but your department may have promised an individual a specific payment regardless of taxes.

How To Gross Up A Net Value Check

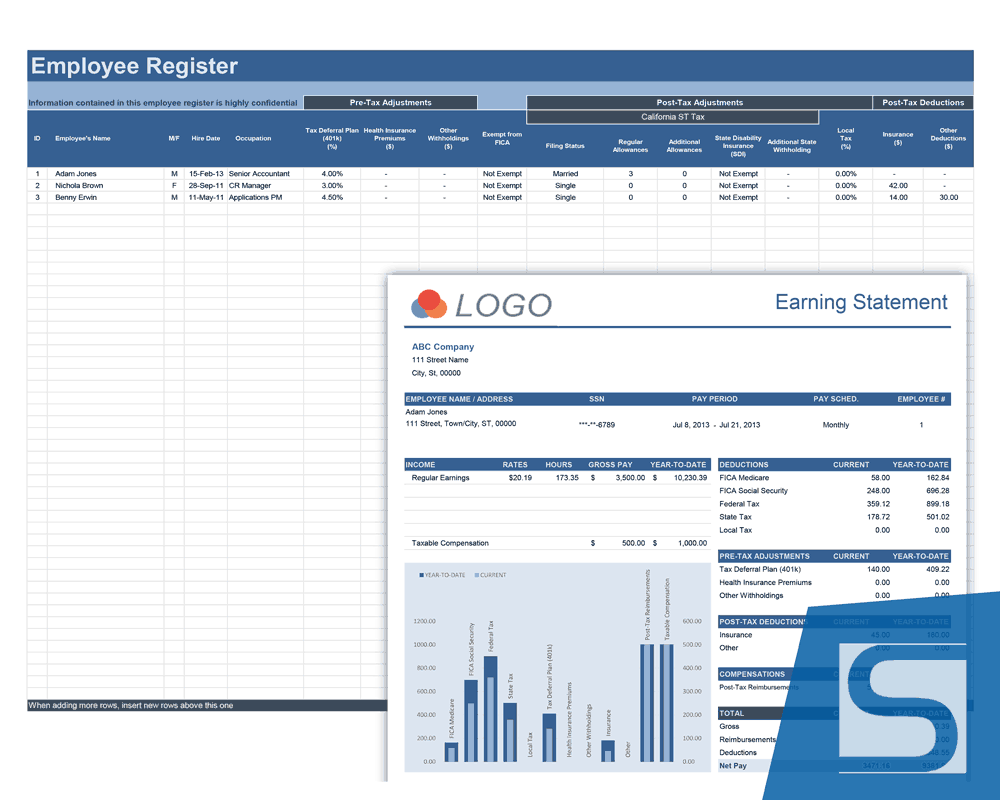

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Employee Payroll Calculator Officetemplates Net

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

A Small Business Guide To Doing Manual Payroll

Different Types Of Payroll Deductions Gusto

Payroll Calculator Free Employee Payroll Template For Excel

Gross Up Payroll Calculator Paycheck What If For Microsoft Dynamics Gp

Avanti Gross Salary Calculator

How To Calculate Net Pay Step By Step Example

Net To Gross Calculator

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Your Easy Guide To Payroll Deductions Quickbooks Canada

Gross Pay Definition What It Is How To Calculate It Sage Advice Us